How can SMEs keep their heads above water amid the COVID19 Crisis?

Total Views |

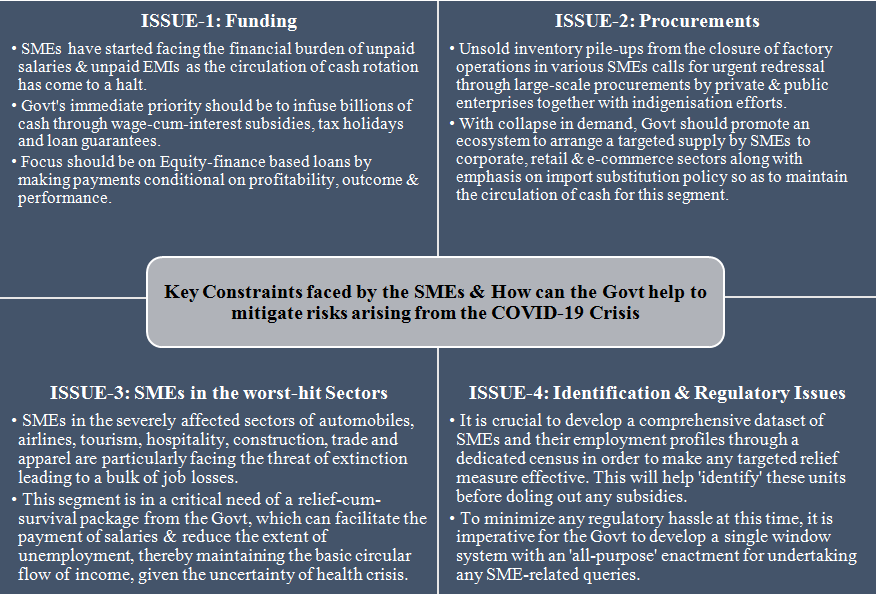

As the global economy confronts the unprecedented onslaught of the COVID-19 pandemic and its exponential spread,it has directly affected India both through the sheer magnitude ofhealth emergency andthe consequent lockdown of domestic activities that hasput a halt to production, disrupted businesses and collapsed consumption, therebytriggering anunforeseen economic crisis. Small and Medium Enterprises (SMEs),in particular, have been all the more vulnerable in thispandemic-induced catastrophe sincethey are disproportionately affected from both the supply and demand-side shocks causedby the breakdown insupply chains, shutdown of factories, dislocation of labour, sudden loss of demand and difficulties in meeting capital requirements. Since this sector was already reeling with one stumbling block after another, be it demonetization or the cluttered implementation of the GST policy or the slowdown in automobile sector to which SMEs constitute the main source of suppliers, the current economic downturn seems to be the finaljolt, which warrants urgent attention and immediate assistance in terms of financial stimulus and a safety net to keep them afloat.

In India, SMEs constitute the backbone for a growing economy as they offer backend support to various large-scale companies spread across different sectors, provide employment to around 40 percent of the workforce and contribute nearly 30 percent of the country’s GDP and close to half of total exports, thereby catalyzing transmission linkages and enabling socio-economic transformation. The coronavirus crisis has adversely affected these channels as recently emphasised by the survey of All India Manufacturers Organisation (AIMO) that necessitate a meticulous reflection in order to be able to devise a suitable strategy.

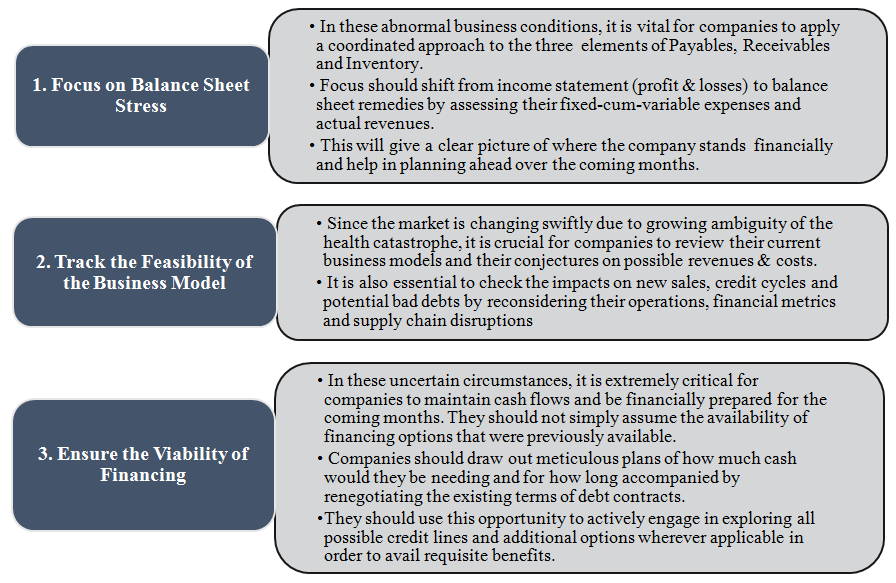

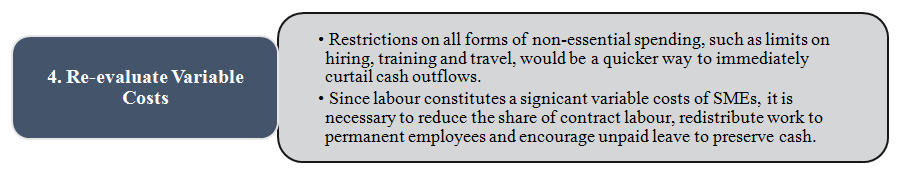

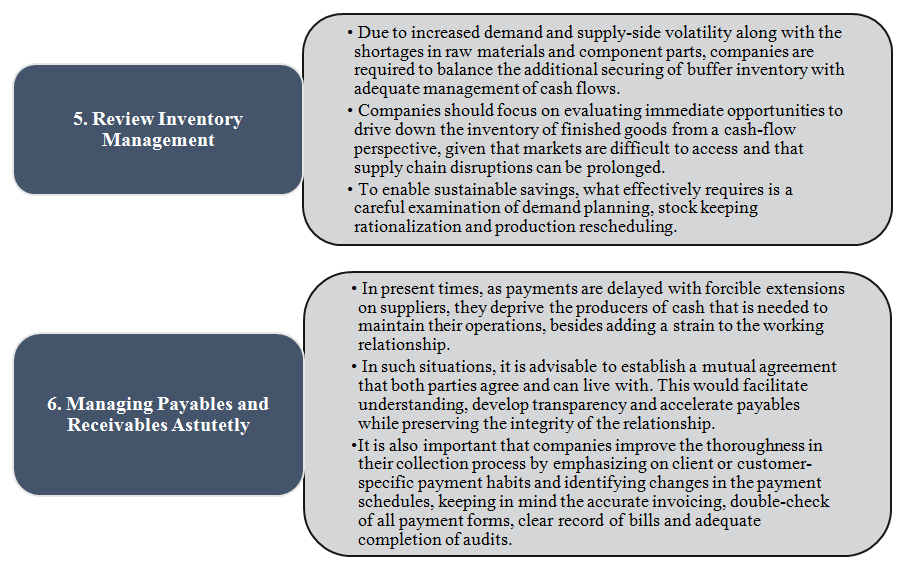

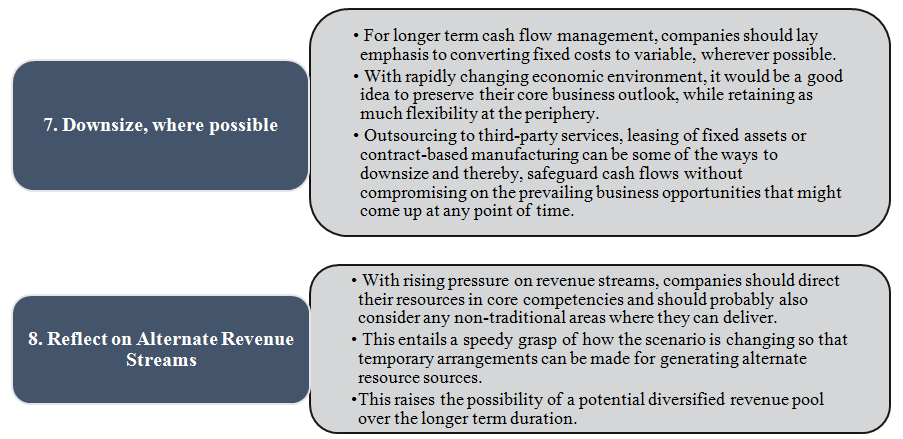

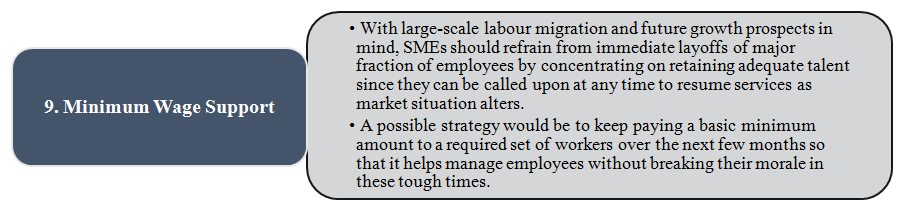

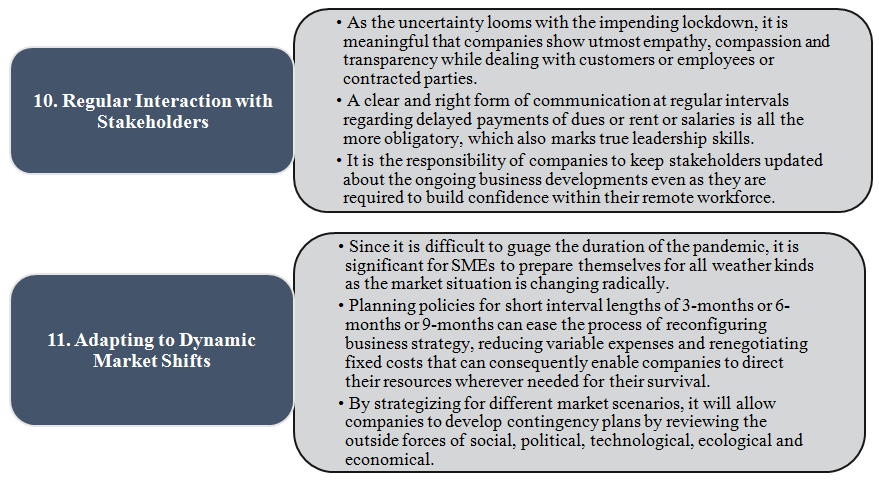

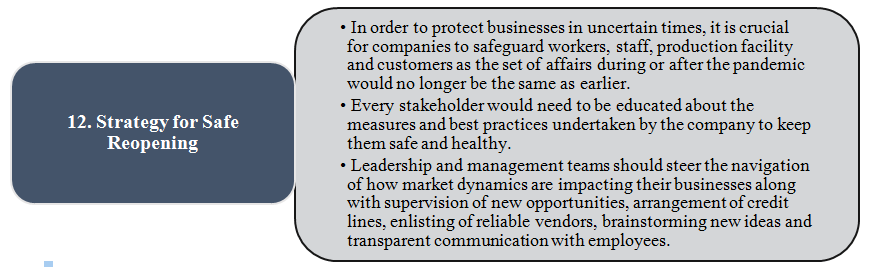

Up till now, the Reserve Bank of India (RBI) has announced a slew of measures including the infusion ofRs.1 lakh crore into the financial institutions, alleviating working capital financing, deferring interest payments, providing three-month moratorium on term loan payments and directing business continuity measures through the scheduled commercial banks, non-bank financial companies and payment banks. The Small Industries Development Bank India (SIDBI), a financial institution dedicated for the SMEs, has launchedSAFE (SIDBI Assistance to Facilitate Emergency Response against Covid-19) for granting loans to SMEs engaged in manufacturing products or trading in services at a concessional rate of 5 percent with no collateral and minimum paperwork even as various public sector banks have stepped in to offer emergency cash facilities to help this segment tide over the economic fallout. However, despite these measures, many SMEs stare at an uncertain future as they are confronted with the erosion of net worth owing to the ongoing freeze on production and supply coupled with the slowing demand. In these times, it is therefore, specifically indispensableon the part of small and medium companies to respond to the immediate challenge and to comprehend in real time just how they need to adapt their business models to survive over the next few months. Some of the strategies for consideration specific to Indian SMEs are listed below.

Since Covid-19 has so far appeared to be an unrelenting crisis, its consequences are particularly grave for a developing economy like India where majority of jobs are informal with negligible work-from-home possibilities. Since SMEs play a pivotal role in the overall industrial economy with their agility, dynamism, innovativeness and adaptability, it is especially necessary for the Government to nurture and promote this sector through urgent relief and bailout packages considering the substantial social, economic and community spillover effects that this is expected to generate.

Isha Gupta

isha.gupta106@gmail.com

isha.gupta106@gmail.com

Isha Gupta is an Assistant Professor at Ramanujan College (University of Delhi) and a research scholar in economics at the Centre for Economic Studies and Planning (CESP), Jawaharlal Nehru University (JNU). Arecipient of the prestigious Reserve Bank of India (RBI) Scholarship for faculty members for the year 2015-16she has been identified and is under focus as one of India’s upcoming economists.

With research papers already published in Economic and Political Weekly (EPW), her analytical yet diagnostic views have been sought by many. She is regularly invited overseas for presenting her studies and findings and already carries clarity on the impact and solutions on the current industrial scenario in times of economic crisis. With a M.A. and M.Phil.in economics from the Centre for Economic Studies and Planning (CESP), Jawaharlal Nehru University (JNU) she is currently pursuing a Ph.D. in economics from CESP, JNU.