Moratorium facility- to take or not?

Total Views |

Enter Covid - Exit business cycle- salary cycle- life cycle....

Covid has hit hard and made us think about the way we have been living our lives. It has put a compulsory reset to our lifestyles.

Various efforts have been undertaken by the Indian Finance ministry and the Reserve Bank Of India to help people deal with financial crisis arising due to COVID-19. Likewise, the Moratorium facility on all types of loans, was announced by the Reserve Bank of India on 27th March 2020 effective from 1st March 2020.

Although this has become a familiar word to many of us after the COVID 19 pandemic, this word still seems like an invisible Ogre who will eat us up, without warning. There is fear, questions, skepticism about hat this is and how the system exactly works. So here are those answers to those few needling questions about Moratorium.

a)What is Moratorium?

Moratorium is an OPTION given by the banks to borrowers to delay the payment of the installments due on their loans. It is a TEMPORARY SUSPENSION of the loan repayment activity. Moratorium is available of the outstanding principal and interest of the loan; i.e. it is available on the entire EMI amount.

b)Till what period is the Moratorium facility available?

Moratorium was first introduced by the Reserve bank Of India from 1st March 2020 till 31st May 2020 and then from 1st June 2020 till 31st August 2020. There is a discussion that this period might be extended till 31st December 2020, but most banks are averse to such a decision, at the present.

c)Is the moratorium facility only applicable to loans given by banks?

As per the RBI announcement, all commercial banks including small finance banks, regional rural banks, local area banks, cooperative banks, financial institutions, and non- banking financial companies can give moratorium facility to their borrowers.

d)What will be the status of my loan if I do not pay the installments for the moratorium period?

In normal circumstances, as per the RBI guidelines, if a loan installment is overdue for a period of 90 days, it is classified as Non-Performing Asset (NPA). But RBI has specifically stated that the moratorium period will be excluded from the duration of 90 days for classifying a loan as NPA.

So even if you avail moratorium facility and temporarily stop paying installments for the said period, your loan will not be classified as NPA. You will not be declared as a defaulter for not repaying your loan for the moratorium period. It will not affect the asset classification of the bank (Asset because for a bank, the loans given by them form part of their assets).

e) Will I have to pay interest on the outstanding amount of my loan if I avail the moratorium facility?

Yes, interest will accrue on your total outstanding amount.

A Public interest litigation( PIL) was filled in the Supreme court against the interest being charged on loans during the moratorium period.

It is common knowledge that banks are in the business of money. They are profit making entities (HDFC bank is the most profitable bank in India at a profit of INR 27,254 crores, followed by State Bank of India at INR 19,768 crores for financial year 2020). Banks earn money on the interest levied on the loans they give. Whereas, they must pay money on the savings and fixed deposits held by them. This difference between the interest earned and the interest paid is their primary source of income.

Now, if interest on outstanding loans is waived, will the bank be able to pay interest on deposits? Any kind of Interest waiver will jeopardise the financial health and stability of the banks.

f) Will availing the moratorium facility affect my credit standing?

No, as per the RBI guidelines even if you avail the moratorium facility, it will not affect your credit rating.

Credit score is important as it helps the lenders to gauge the capacity of the borrowers to repay the loan. It is an important factor in deciding the amount of the loan sanctioned to a borrower.

CIBIL score is a widely used credit score in India. Trans Union CIBIL ltd is the first credit information company in India. It provides credit score for an individual or a corporate based on their repayment records for loans and credit cards. This score enables the lenders to evaluate and approve loan applications.

g)On which kind of loans is moratorium available in India?

Moratorium can be availed on the following types of loans: Home loans, Personal loans, Educational loans (it is normally available on all educational loans, where moratorium period is extended up to 1 year after the student finishes his/her course, in which period the student can fetch a job and repay the loan), Automobile loans, working capital loan, Consumer durable loans, Credit card dues, Term loans, agricultural loans, crop loans etc.

Now we look at the most important question-

h) Should moratorium facility be availed?

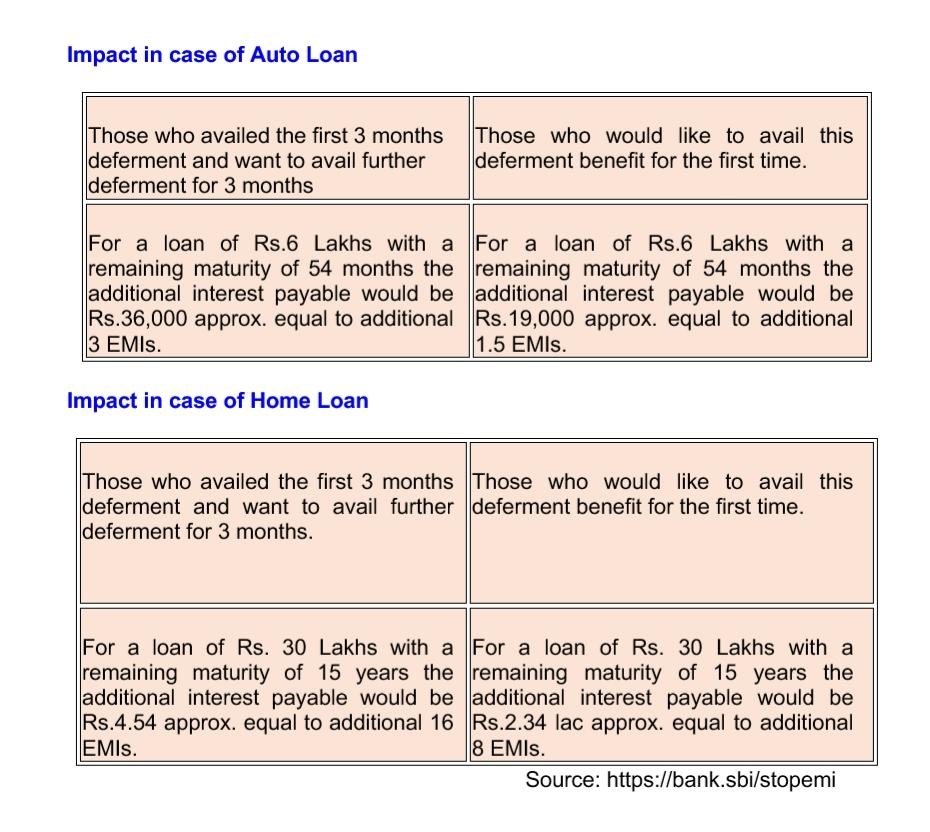

It is critical to understand that moratorium is NOT LOAN WAIVER. It is just a deferment of your dues and not a waiver of your repayment obligation. The terms and conditions of your loan will not change. You will have to pay extra interest on your outstanding loan during the moratorium period.

Thus, if you have a steady source of income, it is pertinent that you stick to the repayment schedule and not avail moratorium facility.

But, if your income has been impacted due to lockdown or you are facing liquidity issues or irregularity in cash flows, you should avail this facility.

For example, if you are paying an EMI of INR 30,000 per month and you have availed moratorium for 3 months from March to May, INR 90,000 (30,000 x 3 months) will get added to your principal outstanding. You will have to pay extra interest on a higher principal amount for the remaining period of your loan. In effect, you will end up repaying more loan and for a longer duration as well.

Below are illustrations from State Bank of India which will clearly help you understand the impact of moratorium of your loans.

Most banks have provided ‘opt out’ facility for moratorium where the borrower will have to opt out of moratorium facility. A few banks have asked its borrowers to opt in for this facility by filling a form to the effect.

Most banks have provided ‘opt out’ facility for moratorium where the borrower will have to opt out of moratorium facility. A few banks have asked its borrowers to opt in for this facility by filling a form to the effect.To decide the need to take up this facility, an individual or a corporate should clearly assess their incomes and expenditure for the forthcoming quarters. If the circumstances so arise that loan repayment for some time would be difficult, then this facility should most definitely be availed, BUT AS A LAST RESORT. Shri Aditya Puri in the Annual General Meeting of HDFC Bank held on 18th July 2020 said that only 9% of the bank borrowers had availed of the moratorium facility.

Take for example, I go to a restaurant and a complimentary wine bottle is kept on my table. If I am a teetotaler, will I drink that wine even if it is free? To avail the moratorium facility, one should have a clear understanding of one’s finances and then take an informed decision.

Shephalika Gokhale

Besides working as a Trainer for banks and corporates in areas of general management, investor awareness programs, customer service etc., Shephalika has also worked as Manager (Customer service and Retail Operations) for more than 6 years with IDBI Bank. She also has been teaching at various management institutes and commerce colleges in Pune for the past 11 years.

While pursuing her PhD, she concluded that knowledge about money matters in simple, local language which is easily understandable is lacking. The level of financial awareness about investments and savings is worrisome, not just with adults but also in the young earning group. Managing one’s corpus needs a holistic approach keeping an eye on the various environmental factors. It is this need and her passion to educate people on matters of personal finance, led her to start sharing tips and writing for the layman. Her simple writing is hugely popular and widely read.